This article breaks down the definition, quality criteria, pricing benchmarks (split by PCR and truck tires), and critical import considerations, using examples of common domestic brands (e.g., Chaoyang, Linglong, Double Star) to provide practical guidance.

1. What Are Used Tires? Sources and Classification

Used tires refer to tires removed from vehicles after their primary service life. Common sources include:

End-of-life vehicle dismantling: Tires from scrapped or parted-out cars, trucks, or SUVs.

Vehicle maintenance replacements: Tires swapped during routine upkeep (e.g., switching to winter tires).

Commercial fleet retirements: Tires from delivery vans, taxis, or rental fleets after accumulating mileage.

Used tires are categorized by:

Passenger Car Tires (PCR): For cars and SUVs, with common sizes like 185/65R14 or 205/55R16.

Truck Tires: For light trucks (e.g., Ford Transit) or heavy-duty trucks (e.g., semi-trailers), with sizes like 215/75R15 or 275/70R22.5.

2. 5 Core Criteria for High-Quality Used Tires

Not all used tires are equal—some may still offer years of safe service, while others are unsafe. High-quality used tires must meet strict standards:

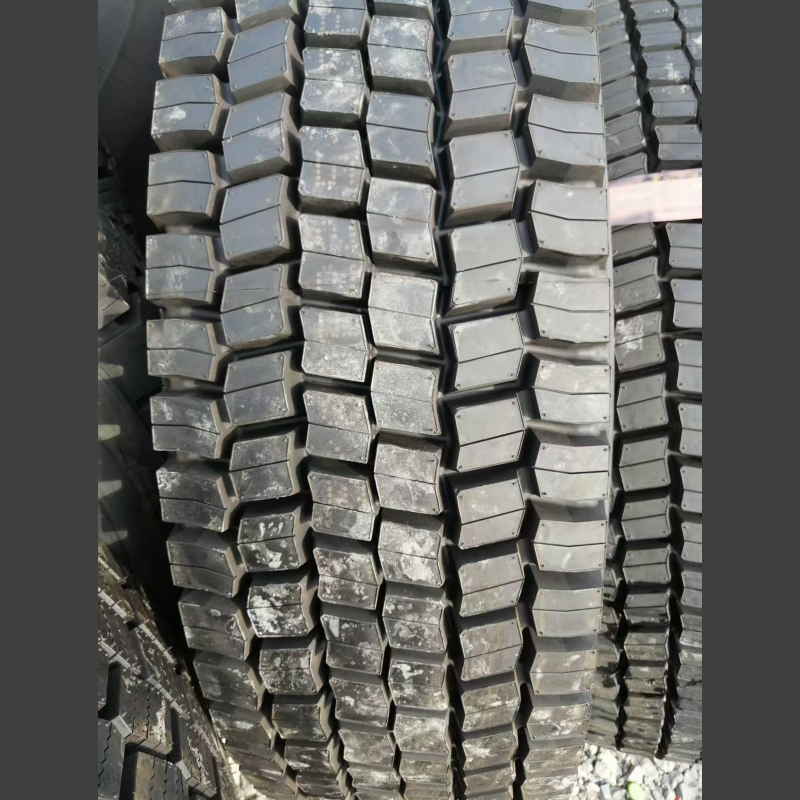

1. Adequate Tread Depth: The Safety Baseline

Tread depth is the most critical factor, directly impacting grip and water drainage.

Regulatory Requirements: China’s GB 7258-2017 (Road Vehicle Safety Technical Conditions) mandates a minimum tread depth of 1.6mm (2/32 inch) for passenger cars and 3.2mm (4/32 inch) for commercial trucks.

Practical Measurement: Use a tread depth gauge. For example, a Chaoyang 185/65R14 tire with 4mm tread depth (well above the limit) can safely last 2-3 years; one with 1.8mm (near the limit) is only suitable for short, low-speed use.

2. Structural Integrity: No Hidden Risks

Inspect for internal structure damage that could cause blowouts:

Sidewall Cracks: Deep cracks (>6mm) or web-like patterns (over 3 cracks) weaken the tire’s skeleton.

Bulges/Blisters: Indicate internal pressure issues or belt separation—avoid tires with bulges >20mm.

Punctures/Cuts: Wounds >25mm long or penetrating the carcass (exposing cords) require repair or retirement.

3. Even Wear Patterns: Reflecting Proper Use

Uniform wear (tread depth variation ≤1mm) signals normal alignment, tire pressure, and suspension. Severe unevenness (e.g., feathering, cupping, or one-sided wear) suggests misalignment, over/under-inflation, or suspension issues, shortening lifespan by 30%.

4. Clean, Dry Condition: Extending Lifespan

Surface Cleanliness: Free of oil, mud, or mold (mold accelerates rubber degradation).

Storage Environment: Dry (humidity <60%), well-ventilated, and shaded (UV exposure ages rubber). Tires stored outdoors (e.g., construction site scrap) may have brittle rubber—exercise caution.

5. Verifiable Service History: Reducing Risk

High-quality used tires should have clear records:

Original owner/fleet information (to avoid stolen tires).

Total mileage (e.g., “80,000 km”).

Maintenance history (e.g., “repaired once in 2023”).

Retread records (if applicable, with details of the retread facility’s certification). Tires with no history (“black tires”) carry high risk.

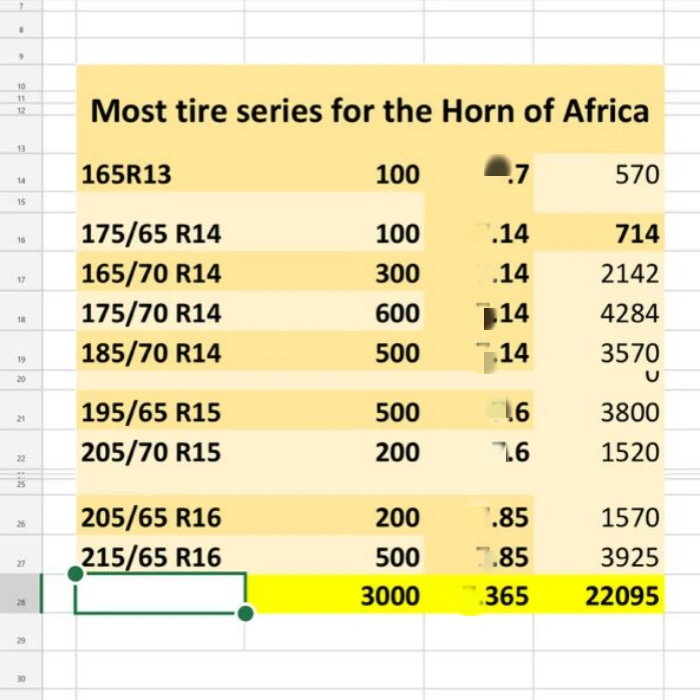

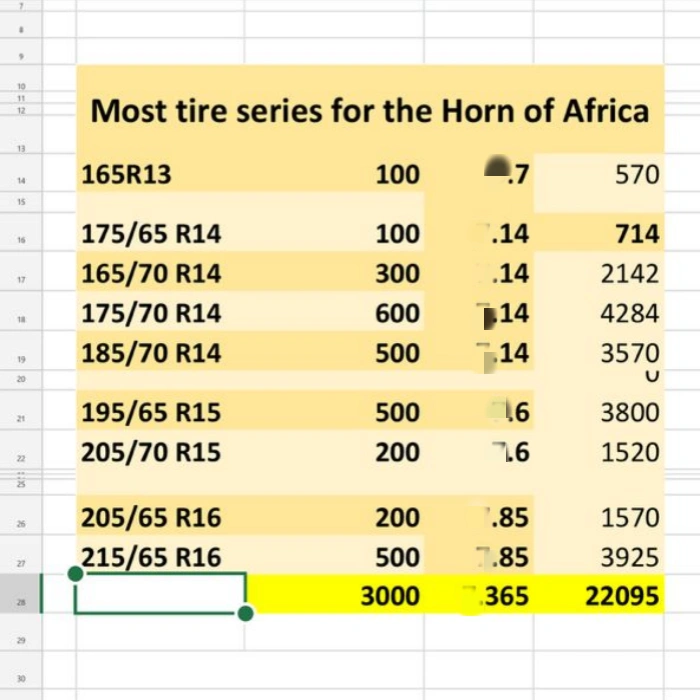

3. Pricing of Chinese Used Tires: PCR vs. Truck Tires (2024-2025)

China is the world’s largest used tire market (annual transactions exceeding 20 million units). Prices vary by brand, model, tread depth, and regional supply. Below are 2024 retail prices and 2025 import estimates (factory direct + taxes + logistics) for common domestic brands:

1. Passenger Car Tires (PCR)

Examples: Chaoyang 185/65R14, Linglong 205/55R16.

| Tread Depth | 2024 China Retail Price ($) | 2025 Import Price (Factory Direct + Taxes + Logistics, $) |

|---|---|---|

| 1.6-2.5mm (Critical) | $8−$12 (short-distance use only) | $9−$13 (includes 1.5customsfee+0.5 logistics per tire) |

| 2.6-3.5mm (Good) | $12−$18 (daily use) | $14−$20 (mainstream procurement price) |

| 3.6mm+ (Excellent) | $18−$25 (long lifespan) | $20−$28 (ideal for fleet bulk purchases) |

Case Study: A Chaoyang 185/65R14 tire with 3.2mm tread depth (good condition) retailed for 151.5 customs + 0.819 per tire.

2. Truck Tires

Examples: Double Star 215/75R15 (light truck), Aeolus 275/70R22.5 (heavy-duty).

| Tread Depth | 2024 China Retail Price ($) | 2025 Import Price (Factory Direct + Taxes + Logistics, $) |

|---|---|---|

| 3.2-4.0mm (Critical) | $25−$35 (short-haul freight) | $28−$38 (includes 2customs+1 logistics per tire) |

| 4.1-5.0mm (Good) | $35−$45 (medium-long haul) | $40−$50 (mainstream fleet procurement price) |

| 5.1mm+ (Excellent) | $45−$55 (heavy-duty/long-haul) | $52−$62 (ideal for logistics companies’ bulk stockpiling) |

Case Study: A Double Star 215/75R15 tire with 4.5mm tread depth (good condition) retailed for 402 customs + 1.247 per tire.

4. 10 Critical Considerations When Importing Used Tires from China

Importing used tires may seem “low-cost,” but overlooking details can lead to financial loss or safety risks. Follow these key guidelines:

1. Verify Tread Depth and Structure: Reject “Black Tires”

Request tread depth inspection reports (with photos/videos), focusing on sidewall and tread edge cracks.

If reports are unavailable, demand live video verification (use a flashlight to check for exposed cords in the sidewall).

2. Validate “Service History”: Avoid Stolen/Scrap Tires

Require original vehicle information (license plate, VIN) or fleet purchase records (contracts, invoices).

Beware of “source-less” tires—China’s customs may detain imports without legal documentation, exposing buyers to fines.

3. Clarify “Retread Standards”: Retreads ≠ Poor Quality

Legally retread tires must pass GB 14646-2016 (Retread Tires) certification, with new tread rubber and intact carcass cords.

Low-quality retreads only regrind the tread and reapply patterns—avoid these, as their carcass may be degraded.

4. Negotiate “Price Breakdown”: Avoid Hidden Costs

Import cost = Factory price + Tariffs (3%-5%) + Logistics (0.52/tire) + Customs fees (13/tire) + Storage ($0.5/day).

Demand a detailed quotation from suppliers, specifying all fees to avoid “port-of-entry price hikes.”

5. Choose “Reliable Transportation”: Minimize Cargo Damage

Prefer full container load (FCL) over less-than-container load (LCL) to reduce handling damage.

Require freight forwarders to purchase marine insurance (covers breakage, moisture damage; ~0.3% of cargo value).

6. Check “Customs Documentation”: Avoid Port Detention

Required documents: Commercial invoice, packing list, certificate of origin (China), quality inspection report (tread depth, structure).

For tires from the EU/US, additional E-Mark or DOT certification is needed (otherwise, customs may reject the shipment).

7. Confirm “Storage Conditions”: Prevent Secondary Aging

Require suppliers to clean and dry tires before shipping (use compressed air to remove dirt; air-dry for 7 days).

Store imported tires in a temperature-controlled warehouse (15-25°C, humidity <60%) away from direct sunlight.

8. Sign a “Warranty Agreement”: Protect Rights

Specify a warranty period (3 months recommended) covering structural defects (e.g., blowouts, bulges) not caused by misuse.

Define “non-human damage” (e.g., transportation-related damage is the supplier’s responsibility).

9. Test with “Small Orders” First: Reduce Risk

For first-time partnerships, purchase small batches (50-100 tires) to test quality and supplier reliability.

Scale up (e.g., 500+ tires) only after verifying quality to avoid large-scale losses.

10. Stay Updated on “Policy Changes”: Ensure Compliance

China’s customs is tightening used tire imports—starting 2025, third-party safety certifications (≈$20/tire) may be required.

Consult customs brokers to understand latest rules (e.g., “tire recycling certificates”) and avoid clearance delays.

Conclusion: Balancing Cost and Quality in Imported Used Tires

Importing used tires from China hinges on balancing “quality” and “price”—by rigorously screening tread depth, structural integrity, and service history, and understanding transparent pricing (factory direct + reasonable fees), fleets/dealers can reduce per-tire costs by over 40%. However, low prices do not equal low quality; ignoring inspections or compliance can lead to safety hazards and hidden costs.

For common brands like Chaoyang or Linglong, target tires with ≥3.0mm tread depth and no structural damage, with import prices between 1545 per tire (PCR/truck). This ensures safe, durable performance while achieving cost efficiency. Remember: The value of high-quality used tires lies in their “safe lifespan,” not just their low price.

The above prices are for reference only. You need to discuss with your used tire supplier and reach a cooperation agreement on the premise that both parties can make profits. Contact us now to get the best price.