Introduction

The global demand for wholesale used tires by container has grown steadily over the past decade, fueled by rising raw material costs, environmental sustainability initiatives, and the need for affordable mobility solutions in emerging economies. Purchasing used tires in bulk by container has become a common practice for resellers, tire shops, and distributors across Africa, Latin America, the Middle East, and parts of Asia. For many businesses, this model offers an opportunity to secure reliable supply, competitive pricing, and higher profit margins compared with new tire imports.

In this article, we’ll explore the current used tire market, the pricing of wholesale used tires by container, sourcing channels, quality control, and the business opportunities associated with this sector.

The Global Used Tire Market: Current Situation

If you have been in the used tire business for a long time, you will know that used tires are not uniformly branded, only the size of the tire is considered. If you are a novice, then don't ask your supplier for a specific brand of used tires.

1. Rising Demand in Developing Countries

In developed countries like the U.S., Canada, Germany, and Japan, strict vehicle inspection and safety regulations often require drivers to replace tires once tread depth falls below 3–4 mm, even though these tires still have usable life left. Instead of discarding them, many are exported in containers to regions where demand for affordable tires is strong.

Africa: Nigeria, Ghana, Kenya, and South Africa are major importers of containerized used tires.

Latin America: Countries like Mexico, Colombia, and the Dominican Republic have strong markets.

Asia & Middle East: Pakistan, the Philippines, and the UAE serve as both end-markets and re-export hubs.

2. Environmental & Sustainability Factor

The tire recycling industry cannot keep up with the massive number of discarded tires. Exporting usable tires helps reduce waste while meeting global demand for low-cost mobility. This practice supports the circular economy by extending product life cycles.

3. Containerized Shipping as a Standard

Shipping used tires by container is cost-effective because it allows bulk buyers to consolidate large volumes—typically 1,000–1,500 passenger car tires or 700–900 truck tires per 40-foot HQ container. Efficient packing methods (triple stacking, lacing, or sidewall cutting) maximize space and reduce freight costs.

Pricing of Wholesale Used Tires by Container

The cost of wholesale used tires depends on multiple factors: tire size, tread depth, origin, and container load. Below is a typical price overview (2025 estimates) for bulk purchases.

1. Passenger Car Tires (PCR)

Europe / Japan Origin:

2.5–4.0 mm tread: $8–12 per piece

4.0–6.0 mm tread: $12–18 per piece

6.0 mm+ premium tread: $18–25 per piece

Container load (1,200 pcs average): $12,000–20,000 per 40’ HQ

2. Light Truck & SUV Tires

Mixed sizes: $18–28 per piece

Premium brands (Michelin, Bridgestone, Goodyear): $25–35 per piece

Container load (900 pcs average): $20,000–28,000 per 40’ HQ

3. Truck & Bus Radial Tires (TBR)

30–40% tread: $40–60 per piece

40–60% tread: $60–80 per piece

Premium re-groovable casings: $80–120 per piece

Container load (750 pcs average): $40,000–60,000 per 40’ HQ

4. Off-the-Road (OTR) & Agricultural Tires

Prices vary widely depending on diameter and condition, typically $150–500 per piece.

5. Shipping & Logistics Costs

Freight from Europe to West Africa: $3,000–5,000 per container

Freight from U.S. to Latin America: $2,500–4,000 per container

Customs duties & taxes vary by country, ranging 5%–30% of CIF value.

Estimated landed cost: For buyers in Africa or Latin America, a 40-foot container of passenger car used tires (1,200 pcs) might arrive at $18,000–25,000 total CIF, averaging $15–20 per tire. Resale prices often reach $25–40 per tire, yielding solid profit margins.

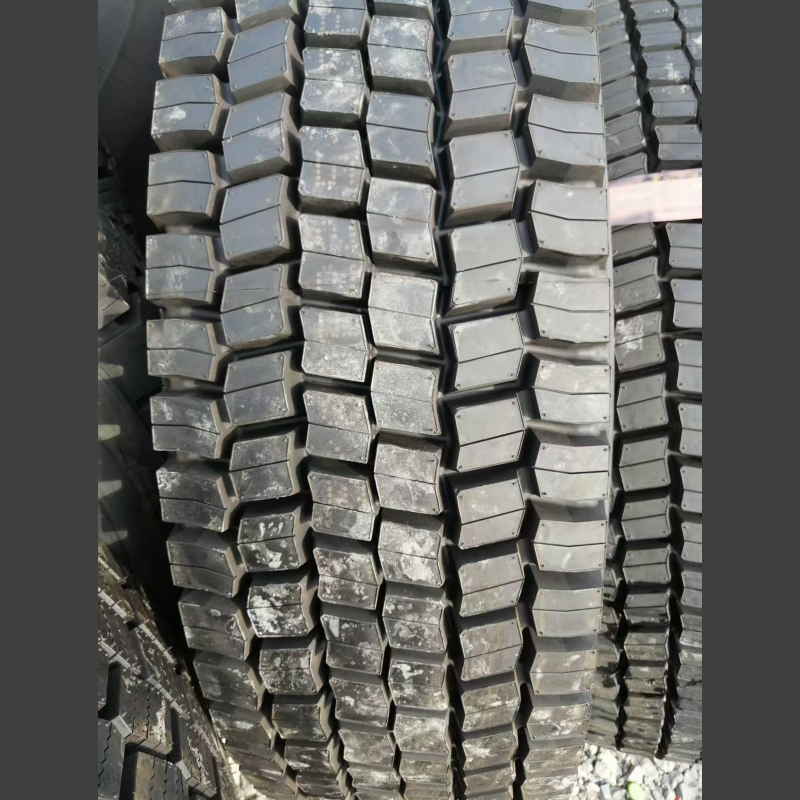

Quality Control in Wholesale Used Tire Trading

Buying wholesale used tires by container requires strict quality assurance to avoid low-value stock. Here are key checks:

Tread Depth Measurement

Minimum 3 mm is standard for exports. Buyers often request 5 mm+ to maximize resale value.

No Sidewall or Bead Damage

Cracks, cuts, or bulges compromise safety and reduce resale potential.

Matching Sets vs. Mixed Lots

Retailers prefer pairs or full sets, while mixed lots are harder to sell.

Brand & Size Mix

Well-known brands like Michelin, Bridgestone, Continental, and Goodyear resell faster.

Common sizes (13–17 inch) move more quickly than niche dimensions.

Supplier Reputation

Reliable suppliers grade, sort, and pack according to customer requirements.

Some exporters provide videos or inspection reports before loading.

Business Opportunities in Used Tire Imports

1. Profit Margin Potential

Importers buying wholesale used tires by container can often achieve 30%–60% gross margin after local resale.

Example:

Import price: $18 per tire (landed cost)

Resale price: $30 per tire

Profit margin: $12 per tire

Container with 1,200 pcs: $14,400 profit

2. Growing Automotive Aftermarket

In regions where the average vehicle age is 10–15 years, demand for affordable replacement tires is very strong. Used tires provide a solution for drivers unwilling or unable to spend $80–120 on new tires.

3. Niche Segments

Taxi & bus operators: Look for bulk purchases of durable used tires.

Agriculture & construction: Demand OTR tires at lower prices.

Motorcycle tires: A growing sub-market in Asia and Africa.

Risks & Challenges

Regulatory Restrictions

Some countries ban used tire imports for safety or environmental reasons (e.g., India, Brazil). Others impose strict quality standards.

Customs & Duties

Unexpected tariffs or inspection delays can increase costs.

Quality Fraud

Unscrupulous suppliers may pack low-grade scrap tires. Always verify suppliers and request loading inspection.

Market Saturation

In certain regions, oversupply has temporarily reduced profit margins. Importers must track demand trends.

How to Source Wholesale Used Tires by Container

Europe (Germany, Netherlands, Belgium):

Reliable grading standards and supply from strict inspection countries.

Japan:

Known for high-quality tires with 6–7 mm tread due to early replacement habits.

USA:

Large volume of mixed quality, more budget-friendly.

Trusted B2B Platforms:

Alibaba, Global Sources, Made-in-China list verified tire exporters.

Direct Supplier Contracts:

Long-term partnerships with scrap yards, collection centers, and wholesale exporters ensure stable supply.

Practical Tips for Buyers

Always request a packing list with brand, size, and tread depth distribution.

Consider third-party inspection companies before shipment.

Factor in shipping costs, duties, and storage fees to calculate real landed cost.

Build local distribution channels (tire shops, garages, roadside dealers) to move stock quickly.

Diversify sourcing regions to mitigate supply risks.

Conclusion

The business of wholesale used tires by container continues to grow, driven by affordability, environmental sustainability, and strong demand in developing economies. While challenges such as regulatory restrictions and quality risks exist, buyers who carefully select suppliers, inspect shipments, and understand their target markets can achieve significant profit margins.

In 2025, a standard 40-foot container of passenger car used tires is priced between $12,000 and $20,000 FOB, depending on tread depth and brand mix. For resellers in Africa, Latin America, and Asia, this offers an attractive opportunity to meet the booming demand for cost-effective mobility while contributing to a more sustainable global tire lifecycle.